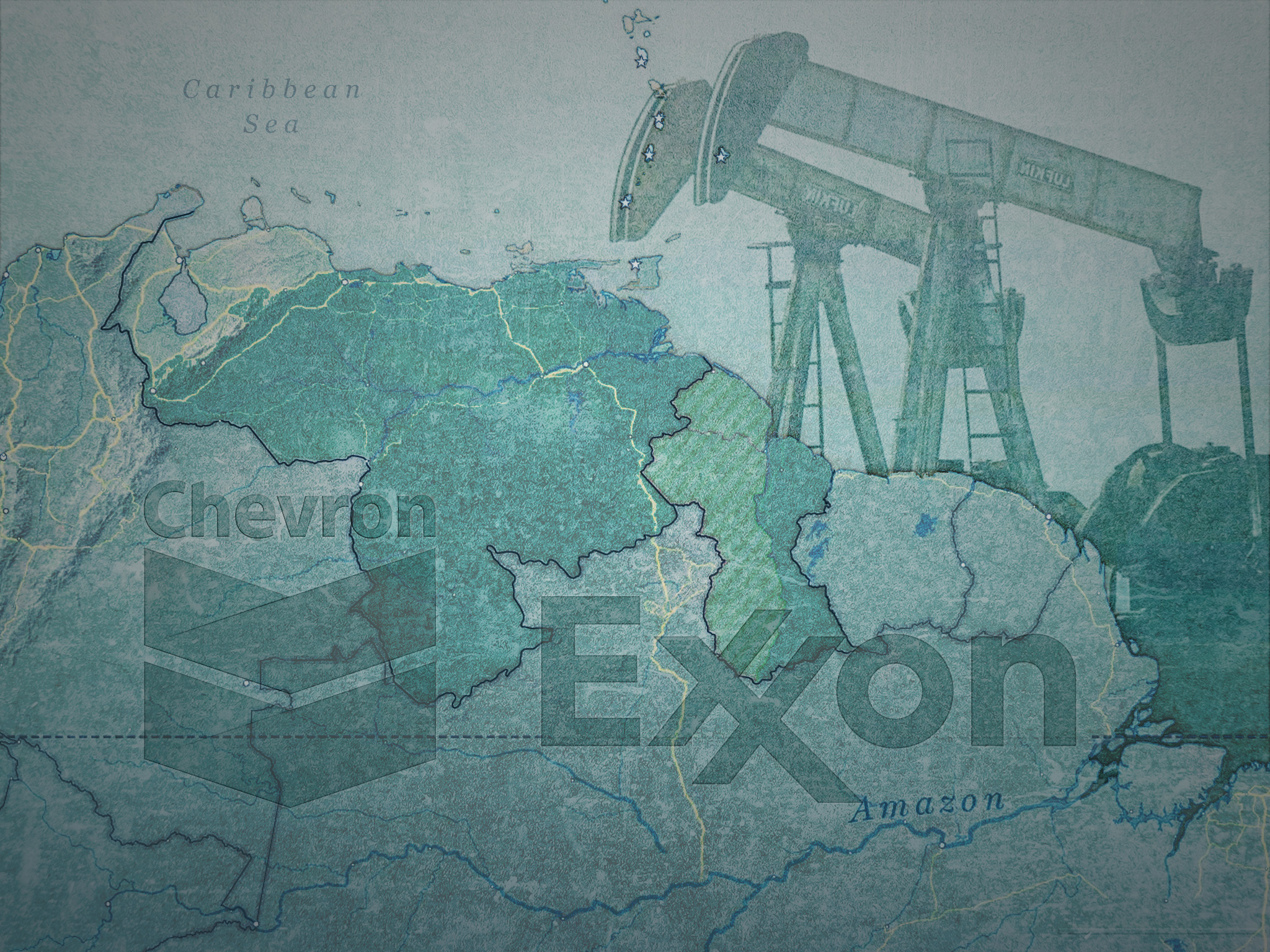

Exxon’s (NYSE:XOM) feud with Venezuela comes knocking at Chevron’s (NYSE:CVX) door, threatening to scuttle $53 billion deal for Hess (NYSE:HES)

A decades-long dispute in Venezuela could be coming back to haunt Chevron (NYSE:CVX) and may quash its $53 billion deal to acquire Hess (NYSE:HES). The complex, multi-party situation has historical connections to the nationalizations that shook the country nearly 20 years ago and now extends into neighboring Guyana, where a significant oil discovery has been made.

In 2015, ExxonMobil (NYSE:XOM) unveiled a major oil find in Guyana’s offshore Stabroek block it operates with minority partners Hess and CNOOC. Production started in 2019 and has turned Guyana into the world’s fastest growing economy.

Chevron, wanting in on the action, in October announced a deal to acquire Hess, which counts the Guyana participation as one of its most prized assets. A successful merger would put Exxon and Chevron at the helm of one of the hottest new discoveries in the world, but their diverging histories in neighboring Venezuela make them strange bedfellows and put them on opposing sides of a very bitter dispute.

The saga took a new twist last week, when Chevron told the Securities and Exchange Commission that Exxon might now be able to block the deal with Hess. The companies didn’t mention Venezuela in the most recent back and forth, but the context is impossible to ignore.

Decades of disputes

Exxon departed Venezuela in 2007 after its assets in the country were nationalized by former President Hugo Chavez, and it’s tried to recover billions in arbitration tribunals and courts around the world.

Conversely, Chevron chose to stay in the country and gave the government controlling stakes in its projects in a polarizing move. Critics have accused the firm of providing a financial lifeline to the regime of Chavez’s successor, Nicolas Maduro, amid ongoing allegations of human rights violations and repression. Company defenders say it’s simply protecting its long-term investment in infrastructure, supplying the country with a needed source of hard currency for imports of food and medicine amid stringent US sanctions.

While Exxon has struggled to recover compensation from Venezuela in court, it now has a chance to punish a friend of its enemy, asserting what it says is its right of first refusal to any ownership changes involving the Guyana block.

Chevron said in a filing with the SEC that the deal could fall through if it can’t negotiate an “acceptable resolution.”

Guyana’s rush for black gold

Exxon said last month that total production capacity in Guyana had already reached 620,000 barrels per day. That’s an embarrassing figure for Venezuela, which, after decades of mismanagement and expropriations has seen its oil output decline to under 1 million barrels of oil a day from a peak of nearly 3.5 million back in 1997.

Indeed, it’s no surprise that Guyana’s good fortunes have provoked the ire of a cranky Maduro, who’s ratcheted up tensions surrounding a long-running border dispute between the two countries.

Despite all the rhetoric, one thing is clear: Guyana, with Exxon’s help, is getting the oil out of the ground and transforming its economy, something Venezuela has struggled with in recent years, despite having the largest reserves in the world.

The burgeoning oil boom in Guyana underscores Venezuela’s missteps, and Chevron’s possible setback not only highlights the tangled web of international oil politics but also signals the high stakes involved in the region’s energy future. Venezuela is a land of endless resources and potential, but past grievances will need to be settled before any recovery can take hold. Long buried disputes will come bubbling up when the money starts flowing, even in neighboring countries.