Buy now, pay later

The internet is the greatest creation we have; everything is on the network, information, entertainment, commerce; even in recent years, finances have come into the digital world. Cryptocurrencies have captured the attention of many people, especially Bitcoin, which is called “the money of the internet,” and this is where competition with traditional finance, such as banks begins.

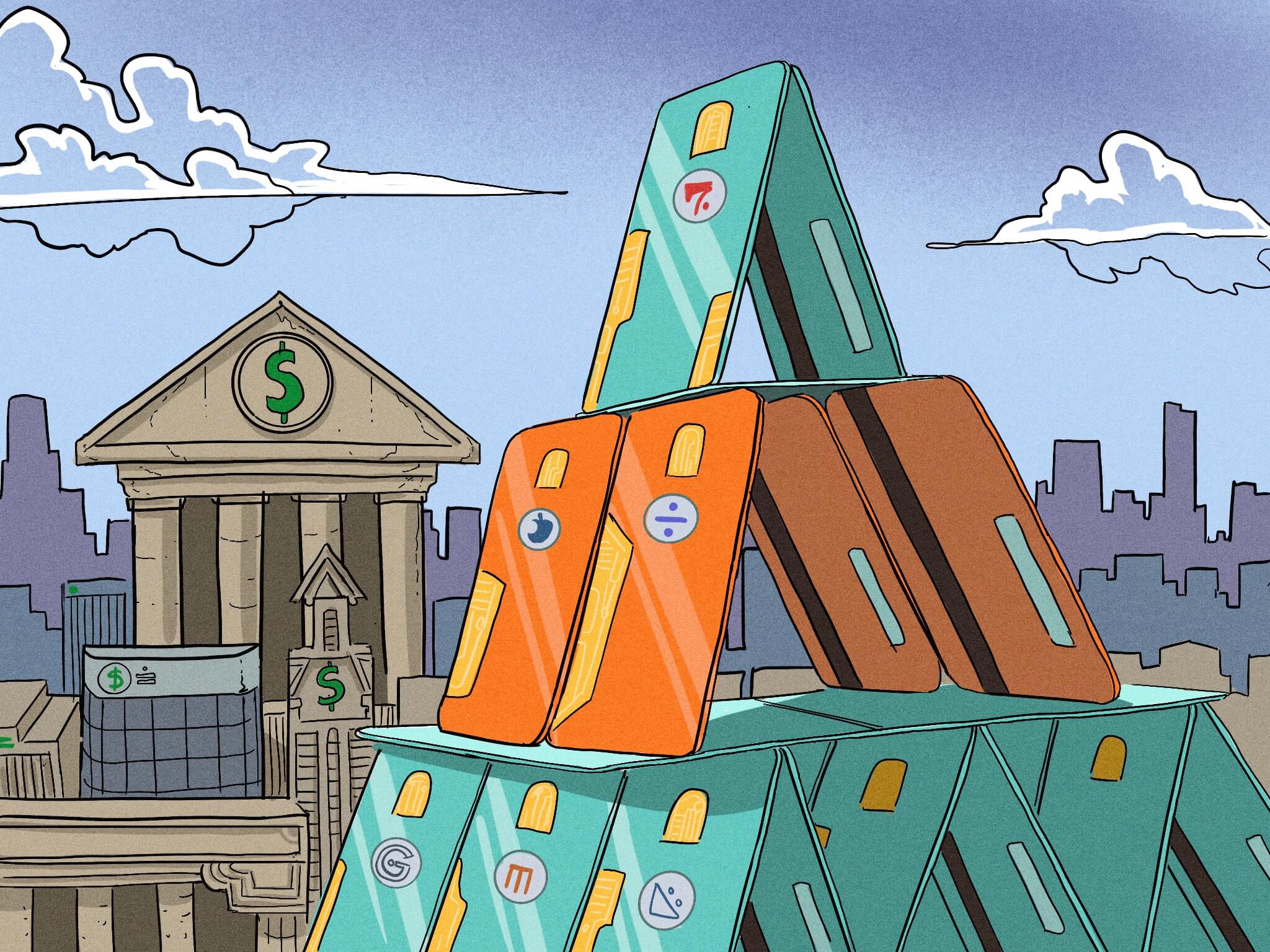

Personal finances are one of the most difficult aspects to analyze since nowadays, circumstances are very changeable, and we all use different payment systems. This gives us an overview of the fragmentation of the financial system worldwide. While some continue to opt for traditional systems, others are constantly looking for innovation and greater economic benefit, companies that offer better conditions.

The financial system is currently in a great battle, as large banks such as Bank of America (NYSE: BAC) or Wells Fargo (NYSE: WFC) are immersed in a high-performance race against digital banks or FinTech that are offering more favourable conditions for users. In this regard, the technology they implement allows them to significantly reduce the costs of keeping the system working.

The context of economies worldwide makes the trend to reduce these costs and, in some cases, seek additional funding at the time of purchase. Although banks are offering this possibility, the easiest option is always to resort to our credit card, and that is where companies like Visa (NYSE: V) or MasterCard (NYSE: MA) are making waves with this abrupt price increase in the goods we consume on a daily basis.

In the midst of this massive use of credit cards, technology companies do not stop innovating, and for some years, they have been creating their payment applications, allowing users to pay for different products or services using cell phones and NFC technology, as we have already seen in companies like Google (NASDAQ: GOOGL) with Google Pay or on the iPhone with Apple Pay. Big technology companies, hand in hand with credit card companies, are entering into direct competition with banks.

And when we talk about improving a system or method to make a certain action, Apple (NASDAQ: AAPL) is always pending, and they have decided to improve Apple Pay, giving it a differentiation, “buy now, pay later” can give us a clue as to where they are improving their payment systems and, is that now it is Apple itself that allows users who use the apple payment application, to finance their purchases in up to 4 equal payments, without surcharges or interest, being undoubtedly a disruptive model and that leaves many competitors out of the market.

Technology companies are giving a new twist when it comes to making payments, and “digital banks” have a great opportunity. Companies like Mercado Libre (NYSE: MELI) have played their cards right, offering the largest e-commerce service in Latin America but also implementing their own payment gateway, Mercado Pago. Its rapid expansion allowed the company to make inroads in the financial aspect of commerce, allowing users to get returns for their money in the application, and more recently, with the implementation of credits for users to purchase products, Mercado Libre (NYSE: MELI) who does the financing of the same.

Apple (NASDAQ: AAPL), being one of the technology companies with the largest market capitalization in the world, is expanding its horizons with Apple Pay, giving its customers the opportunity to finance with the apple company itself.

Is Apple on its way to becoming a digital bank?